Mortgage Amortization: What Homeowners Need to Know

If you have bought your house by taking on a huge loan like many people do, you have probably wondered about mortgage amortization and how it really works. Today, we are here to explain the concept as well as we can, so you will completely understand the meaning of mortgage amortization by the end of this article.

What Is Mortgage Amortization?

Mortgage amortization is the process by which the borrower slowly pays off the home loan they have taken on a regular basis for a period that typically lasts between 15 and 30 years. These monthly payments go toward two things: the principal, which is the actual amount of money you have borrowed, and the interest, which is the cost of borrowing that money. The amortization period is the total number of years it will take you to fully pay off the loan.

What Is A Mortgage is an essential read we recommend you take on if you feel like you don’t know enough about the subject.

How Does an Amortization Schedule Work?

An amortization schedule is basically a roadmap showing you all the individual payments you will need to make and the interest until the loan balance reaches zero. It is a detailed mortgage payment breakdown that tells you how your mortgage will be paid off over time. Here are the things you can see in a mortgage schedule:

- How much of the payments goes toward interest and how much toward principal. Note that at the beginning, most of the money you pay goes toward interest, and the closer you get to the end of the amortization period, the more of the money goes toward principal, because the interest is calculated on the remaining balance.

- The total balance remaining. You can see how much the debt has reduced and how much more is left to pay off.

- It maps out the full loan life, month by month, for the entire amortization period.

Note: Some lenders give you the amortization schedule in print along with other documents; some will even give you the PDF version if you ask for it; and lastly, you can just use online tools to see the schedule.

Common Amortization Periods (15, 20, 30 years)

Amortization periods vary based on the country you live in and your specific financial circumstances, but we do have a few common ones almost everywhere:

- 15 years: Faster payoff, higher monthly payments, but less interest paid overall.

- 20 years: Middle ground between short- and long-term options.

- 25 years: Standard in Canada, often the default if you put less than 20% down.

- 30 years: Standard in the U.S., lower monthly payments but much more total interest.

- 40 years (less common): Sometimes available as an extended option, but rare and usually more expensive over time.

If you are nearing the end of your mortgage term, Mortgage Renewal Tips is a great article you can take a look at.

Example Amortization: Simple Sample Schedule

Here is a very simple example of an amortization schedule:

- Loan Total Balance: $100,000

- Interest rate: 6%

- Amortization Period: 5 years (60 months)

- Payment: about $1,933 per month

Here’s how the first few months look (rounded):

How Extra Payments Affect Amortization

Extra mortgage payments have an enormous impact on the amortization period and the interest you pay. There are 3 main types of extra payments:

- Regular extra payments: adding, say, $100–$500 to each monthly payment.

- Lump-sum payments: occasional large payments (like a tax refund or bonus).

- Accelerated payment schedules: paying biweekly instead of monthly, which effectively adds an extra month of payment each year.

Here are two of the most important impacts of extra payments:

1. Shrinking the Principal

The important thing about extra payments is that they all go directly toward paying off the principal only and not the interest. This way, the interest you pay will go down significantly in the long run.

2. Finish Paying Sooner

By making regular extra payments, you substantially reduce the amortization period. For example, even a little extra payment on a monthly basis can reduce your 25-year amortization period to 21 years.

We strongly recommend that you ask your lender about extra payments because some mortgages have prepayment penalties or limits on how much extra you can pay annually.

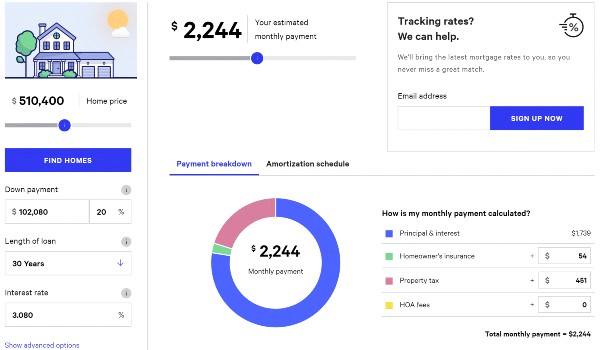

Mortgage Amortization Calculator & Tools

There are a variety of tools that can show you the entire mortgage schedule, the interest, the split between interest and principal, different scenarios with extra payments, etc. Here are the different types of tools that help with mortgage amortization:

- Online Bank Calculators: Many banks have a website tool you can use to see your monthly payments, split payments into principal & interest, and view full amortization tables. An example would be the Bankrate online tool.

- Other Online Calculators: There are online tools designed by organizations other than banks that you can use. Calculator is one of them.

- Mobile Apps: Many apps, such as Zillow Mortgage Calculator, allow you to track your mortgage and even test “what-if” scenarios.

- Excel Sheets: Some lenders provide you with an Excel sheet you can mess around with to test different scenarios.

A quick note: If you are looking for ways to negotiate with the lender to bring that interest down, Mortgage Interest Deduction is what we suggest.

Benefits of Understanding Amortization

When you don’t understand something, you have no control over it, and when it comes to finances, not having control over your money flow is definitely not a good thing. Here are some of the benefits of understanding amortization:

- Keep Track

When you know how much goes into interest and how much into principal, you can keep track of your money and the total balance.

- Make Extra Payments Intelligently

When you understand how a mortgage works, you can make extra payments in ways that will reduce the interest you pay by thousands of dollars while shrinking the amortization period and paying off the loan sooner.

- Choosing the Best Lender

By understanding mortgage terms and amortization, you can analyze all the different aspects of a house loan to see which lender is offering you the best conditions based on your personal finances.

- No Surprises

Some mortgages have balloon payments, variable interest, or prepayment limits. Understanding amortization helps you anticipate these and plan accordingly.

- Plan Finances Accordingly

By fully understanding how much you are going to pay each month and for how long you will be doing this, and if you want to make extra payments, etc., you can plan ahead and use your money wisely and plan for your retirement accordingly.

FAQs

1. What is the difference between the amortization period and the mortgage term?

The amortization period is the total time to pay off your mortgage (e.g., 25 years), while the mortgage term is the length of your current contract with the lender (e.g., 5 years).

2. Can extra payments shorten my amortization?

Yes, making extra payments directly reduces principal, which can shorten your amortization and save interest.

3. How much interest do I pay in the first year?

It depends on your loan amount and rate, but usually, most of the early payments go toward interest rather than principal.

4. Should I choose a shorter amortization period?

Really depends on your financial situation. Choosing a shorter period raises monthly payments but reduces total interest and helps you pay off the mortgage faster. So, if you can comfortably afford it, definitely.

Final Thoughts: Use Amortization to Plan Smarter Mortgage Decisions

It is vital to know about the different aspects of a mortgage, such as the amortization process. That is because house loans are not insignificant amounts of cash, and you, as the borrower, need to know how it all works in order not to regret anything in the future. So, learn all the basics, take on a loan that sounds reasonable to you, and if you have any questions, you can just ask your lender or simply leave a comment down below, and the Houmse team will answer you as soon as possible.

- In this post:

- What Is Mortgage Amortization?

- How Does an Amortization Schedule Work?

- Common Amortization Periods (15, 20, 30 years)

- Example Amortization: Simple Sample Schedule

- How Extra Payments Affect Amortization

- Mortgage Amortization Calculator & Tools

- Benefits of Understanding Amortization

- FAQs

- Final Thoughts: Use Amortization to Plan Smarter Mortgage Decisions